Nov 28, 2024

Tadas Gricius

In a small business, expense tracking isn’t exactly thrilling. Employers simply want accurate, up-to-date financial records, while employees just want a hassle-free way to upload invoices and get reimbursed quickly.

Why is expense tracking essential for small company owners?

For businesses operating on tight budgets, effectively tracking and approving expenses can save tens of thousands of dollars annually. Implementing a business expense tracking software not only reduces the time spent dealing with paperwork but also boosts employee satisfaction by simplifying the reimbursement process and eliminating unnecessary hurdles.

As a former team lead at a startup company, I’ve experienced firsthand how challenging it can be to keep track of expenses without the help of dedicated software. From juggling receipts and reconciling budgets to ensuring reimbursements are handled efficiently, the lack of a streamlined solution can lead to unnecessary stress, wasted time, and financial mismanagement.

A system tailored for startups

Gotbilled stands out as the powerful expense management software for small business looking to simplify the entire finance workflow. Its intuitive user interface makes it easy for even non-financially savvy users to navigate. From tracking invoices to generating reports, the platform ensures that every aspect of finance management is straightforward and accessible. When creating this system, we always follow the following principles:

User-friendly

Intuitive interface

Simple workflow

Automate as much as possible

Gotbilled is specifically developed with the unique perspective of solving small businesses expense tracking issues. Its features are designed to improve the financial operations that startups frequently struggle with, such as:

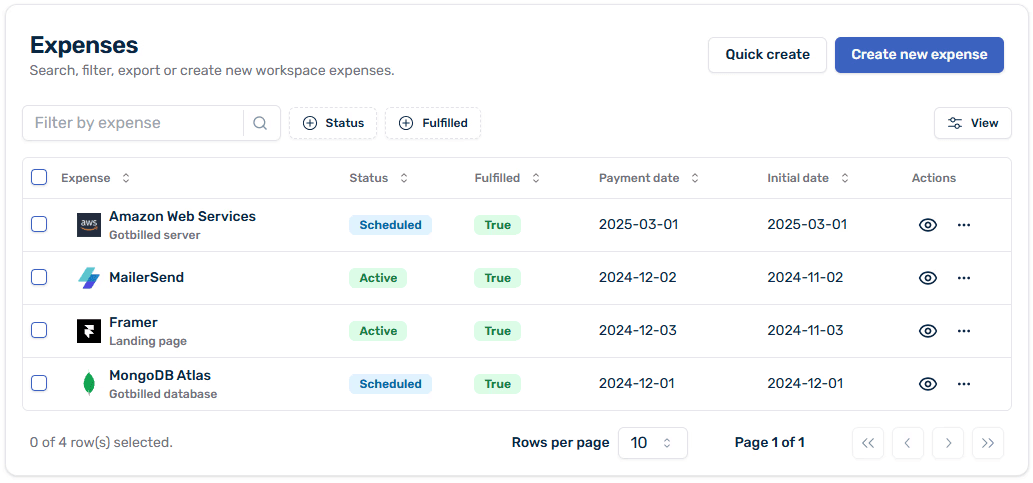

Expense management

All your expenses will be in one centralized place, making it easier to track and organize. With intuitive reports you can see when and how much you will spend on upcoming expenses, ensuring you’re always prepared.

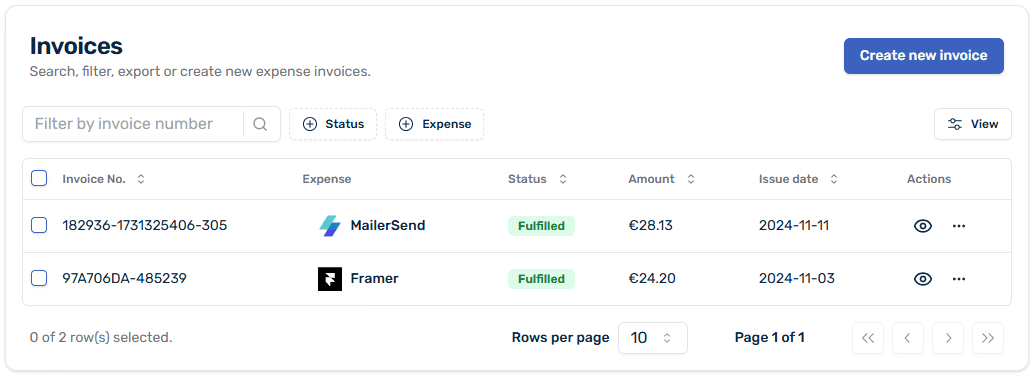

Invoice tracking

With Gotbilled, you can submit, review, and export all expense invoices, request unfulfilled documents, and set automated reminders to always keep you up-to-date with deadlines.

Automated and error-free

Manual expense tracking is prone to human error, leading to discrepancies that can cause major financial headaches. Gotbilled eliminates this risk by automating several critical processes. For instance:

All under one roof - small company owners no longer have to worry about manually organizing receipts or chasing down unpaid bills. Gotbilled centralizes all financial records, ensuring you have everything you need in one place, accessible at any time.

Smart reminders - never miss a payment or follow-up again. Gotbilled’s automated reminders notify you of pending invoices, helping you maintain positive relationships with vendors.

Currency conversion - with Gotbilled’s built-in currency converter, managing expenses in multiple currencies becomes seamless. This feature is particularly useful for businesses dealing with international clients or suppliers.

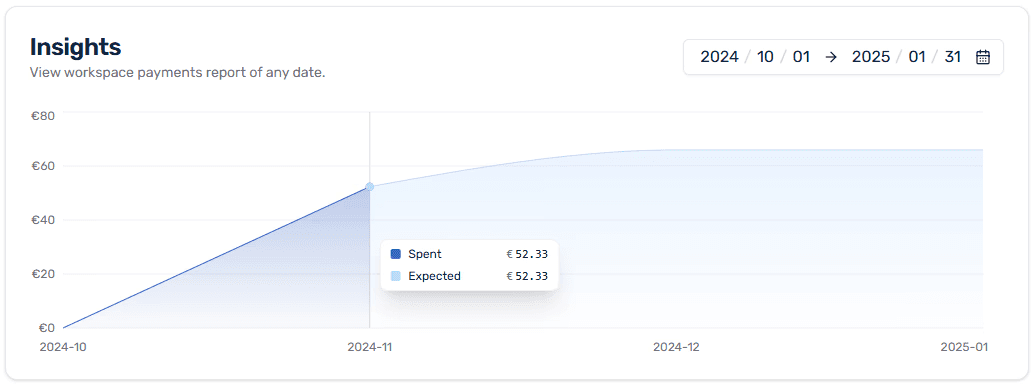

Actionable insights and reporting

Understanding where your money goes is crucial for making informed business decisions. Gotbilled’s insightful dashboards and detailed reports provide a clear picture of your financial health. These features allow you to:

Track spending trends over time.

Project future expenses.

Identify areas where you can cut costs.

The platform’s reporting tools are both comprehensive and user-friendly. These insights empower business owners to make smarter financial decisions without requiring advanced accounting expertise.

Secure and reliable

Financial data security is a top priority for any business. Gotbilled employs modern encryption and secure storage protocols to ensure that your small business expense tracking data remains safe from unauthorized access. Regular updates and stringent compliance with industry standards further enhance its reliability. Business owners can rest assured knowing that their sensitive financial information is in good hands.

Scalable for growth

As your startup grows, so do its financial management needs. Gotbilled is built to scale with your business, accommodating increasing transaction volumes, more complex reporting requirements, and additional users without compromising performance. This scalability ensures that Gotbilled remains a valuable business expense tracking tool as your company evolves.

Why choose Gotbilled over competitors?

While there are many small business expense tracking systems available, Gotbilled distinguishes itself in several key areas:

User-friendly design - unlike complex financial tools that require extensive training, Gotbilled is designed for ease of use, making it accessible for all.

Cost-effective solution - its pricing model is tailored to small companies, offering premium features at an affordable rate.

Feature-rich platform - from automated reminders to multi-currency support, Gotbilled offers a comprehensive suite of tools to meet diverse business needs.

Improved workflow - Gotbilled increases team productivity by eliminating repetitive tasks with an organized approach to manage financial operations.

Conclusion

In the fast-paced world, efficient expense management software for small business is not a luxury but a necessity. Gotbilled combines affordability, functionality, and ease of use to deliver a best-in-class solution tailored to the unique needs of small companies. By simplifying financial management, reducing errors, and providing actionable insights, Gotbilled empowers owners to focus on what truly matters: growing their business.

Whether you’re just starting out or looking to optimize your existing financial processes, Gotbilled is the partner you need to take your small business expense tracking to the next level. With its robust features, exceptional support, and unwavering commitment to improve your company finance management

Was it interesting?

You can share the post

Join our newsletter to receive the latest updates

Be the first to know when we launch new features.